Ratehawk 2021 Outlook – Travel market pulse in a global scale

What super trends are confirmed by Ratehawk and his partners? Digitization and changes in distribution are the future of the industry – who will win this?

An excellent discussion of world-class experts organized in a Ratehawka birthday, one of the most dynamic players on the Travel content directed to agents (B2B).

Ratehawk managed to collect representatives of all key areas of the market. Airlines represented Air Baltic, Hotel -Accor,Transfers – Talixo, Travelgatex Content Aggregator, global payments also present, as well as dynamic packaging at the highest level from Fastpayhotels – and the special quest travel agency from Saudi Arabia.

RateHawk confirms super trends

Ratehawk himself in the founder of Felix Shpilman was confirming super trends, which we also observed in Poland. The first of these is the dominance of the home market / domestic on travel during pandemic. This super trend is already observed for a long time. Also in Poland, the weight of business national journeys increased significantly when the international ones actually froze. Renaissance also experiences national organized tourism, the best example is the success of the Polish project from Nekera.

The second observation is a RM models catastrophe in the face of a pandemic. Nothing will be the same. RM management will not return to models from the epoch before Pandemia. Dramatic shortening of Booking-Window, until the planning of trips from day to day is a mega challenge for RM systems. Working on historical data.

Dubai and Emirates are ruling, Rathawk’s representative stated directly that he did not see so much Dubai sold in his history. This also confirms data from Poland. Just after the presentation, we have a direct flight announcement from LOT Polish Airlines, for which the industry has been claimed for many months/years.

And this is certainly not the end. The opening of the Saudi Arabian representation in the region, which is already expected in a moment, confirms a positive sentiment for business with this part of the world.

Saudi Arabia opens a tourism office for Central Europe – HQ in Warsaw or Prague?

TravelGatex – Super Content Aggregator – More flexible

Spanish Travelgatex is also on the wave. As it aggregates dozens of suppliers also have access to very relevant travel data. For this reason, his representatives often like they have been in the media.

The company itself also faced challenges, which went towards flexibility. Financial terms for partners will therefore be more related to the sale through this less rigid (resignation from the upfront). It’s good for getting new suppliers in the CEE region. IT work on improving the Look to Book ratio it will surely translate into better financial results and greater satisfaction of TravelGatex partners.

The most visionary presentation of Fastpayhotels

In our subjective assessment, the most visionary was the speech of a representative of Fastpayhotels. Its strong belief on the power of direct contracting is focused perfectly on the trends observed on the market. The start-up Roibos described here is the best example that the market goes in this direction.

Dynamic confirmed in real-time prices seem to be superweapons of companies such as Fastpayhotels. Here we also see similarities to Poland. Where dynamic packaging, as the only saved, and even grew on the torn crisis of the tourist market.

Information about the dissemination of branded Fastpayhotels credit cards is impressive with simultaneously limiting their costs for hotels. This is an example of real synergistic action.

A few interesting opinions about the future of digitization of tourist services. As well as greater concentration on the content of apartments and smaller private facilities were not less interesting than others.

Transfers, TMC and hotels and Air Baltic also made a much interesting discussion

Talixo specializing in transfers tried to convince more effectively upselling transfers. Global offer, as well as the need to take care of Covidic security will certainly be favored this offer. Implementation of the content into Self Booking Tools can also help.

Accor, who was a representative of hotels confirmed the highest standards when it comes to security, but also desire to seek new sales ideas. Data presenting reservations in Russia were extremely interesting. Especially, an example of Sochi showing constantly high occupancy, speaks in the country (Poland), which applied the hotels very strong restrictions.

TMC represented the LCC Group. Here also paid attention to domestic travel and not a large number of niche industries that are still traveling on business. As in Poland, Marine Segment distinguished positively on a global scale. LCC is certainly actively looking for ideas for the Pandemic Transition. Emphasizing the importance of cooperation of all market users.

Air Baltic also confirmed global trends. First of all, the boom for holiday travel and a very slow return of the business traffic. Air Baltic reacted very aggressively to these trends – he launched “distant” holiday destinations much faster than LOT. It was no different for flights to the already mentioned Dubai.

It was no coincidence that a representative of the Saudi Group Group Group was in this group. Opening of Saudi Arabia is a fact. Probably soon we will see more flight connections also to this destination. And this will certainly allow for the generation of greater traffic, both to/from this unknown tourist country.

What was missing – more about Sustainability and Justification Tools

The only thing that was a bit missing was a greater emphasis on a potential impact on the market of a pro-ecological approach to travel and elimination of a coal trace. Ratehawk’s representative emphasized the importance of this element only in the question phase. Responding to the question asked by a representative of the Waszaturystyka.pl portal.

The Element of Justification Tool has not appeared at all. Although the Travelixo representative has a little to the topic, pointing to the need to analyze needs in the Business Travel area. However, Justification Tools starts to grow in Western Europe/US, not excluded that we are dealing with the chaining trend. Companies will certainly be interested in tools that will help them in the assessment. If business travel is and in what scale still necessary.

In summary, a very interesting meeting with participants who really observe the global market from the nearest distance. It glad that in many areas the region of CEE and Poland goes in a similar direction as leaders.

Optimistic for the industry of Business Travel are serious technical problems that occurred during the webinar. Showing that even a technology leader, which is undoubtedly Ratehawk does not deal with 100 percent. with virtual meetings. F2F meetings will not go away so quickly to Lamus.

POWIĄZANE WPISY

23 kwietnia 2024

Otwarcie sezonu turystycznego w Chorwacji

180 polskich touroperatorów, agentów turystycznych, ekspertów z branży i dziennikarzy…

0 Komentarzy3 Minuty

20 marca 2024

Festiwal „Szlakiem wody” 22 marca w Hydropolis

Z okazji Światowego Dnia Wody 22 marca 2024 Hydropolis oraz kolektyw Outriders zapraszają…

0 Komentarzy3 Minuty

19 marca 2024

Strategiczna współpraca Banku Pekao S.A. i PLL LOT

Dzięki strategicznej współpracy PLL LOT z Bankiem Pekao S.A. klienci banku mogą korzystać…

0 Komentarzy5 Minuty

15 marca 2024

Blisko 15 mln turystów odwiedziło Egipt w 2023

Na targach ITB Egipt pochwalił się 15 mln odwiedzających w 2023 roku, nowa kampanią…

0 Komentarzy6 Minuty

15 marca 2024

Austria na ITB: innowacje, zrównoważony rozwój i austriacki styl życia

Na ITB Austria przedstawiła nową kampanię promocyjną odwołującą się do „Lebensgefühl” –…

0 Komentarzy7 Minuty

13 marca 2024

DER Touristik zmienia się w Dertour i prognozuje wzrost obrotów o 30 proc. w 2024

W 2023 roku grupa DER Touristik osiągnęła 23 proc. wzrost obrotów i patrzy z optymizmem…

0 Komentarzy5 Minuty

8 marca 2024

MTT Wrocław: rozpoczynamy sezon na podróże

W dniach 22–24 marca we Wrocławiu odbędzie się kolejna, 15. już edycja Międzynarodowych…

0 Komentarzy2 Minuty

4 marca 2024

Nie podzielić losu dinozaura, czyli jak odmłodzić kadry w turystyce? Debata na Forum Promocji Turystycznej

Podczas wiosennej edycji Forum Promocji Turystycznej, która odbędzie się 11 kwietnia 2024…

1 Komentarz2 Minuty

28 lutego 2024

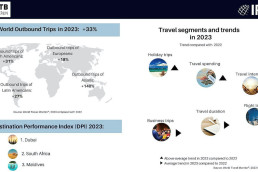

Turystyka wyjazdowa z 33 proc. wzrostem

Zgodnie z raportem przygotowanym przez ITB i IPK International globalna turystyka…

0 Komentarzy5 Minuty

[…] jest teraz na czasie. Rosnące gwałtownie zainteresowanie Dubajem potwierdzają kolejni gracze ze światowego rynku m.in. RateHawk czy Travelgatex. Nie inaczej jest też w Polsce i całym regionie CEE. Wystarczy spojrzeć na […]