Biz travel agents cannot stand more – massive job cuts to start

Global market leaders are no longer waiting for cuts? The avalanche has started? Local leader eTravel is bravely resisting the trend, how is he doing?

The hope for an imminent recovery on the business travel market seems to be evaporating. Some voices say 2024 is set to move closer to pre-Pandemic sales levels. The current sales figures undoubtedly confirm these concerns.

Airline tickets sales -84% in first half of Jan – only exotic destinations keep selling

No more illusions, time of great layoffs

Such a realistic approach to the market is not without consequences in terms of employment decisions. In recent days, we have witnessed some spectacular information on the reduction of staff on the Polish market.

The global giant CWT will reduce even several hundred jobs in Poland. Service center located in Warsaw at Domaniewska Street will suffer the most. The giant, however, has some possibilities of relocating employees/tasks to cheaper locations. For years he has been investing in his Rzeszów branch.

Not better news is also coming from HRG, where significant reductions were also made in recent days. Including those affecting experienced employees, often over 10 years with the company. This clearly shows that the jokes are over on the market.

eTravel saves cooperation with global players

The leader of the eTravel business travel market is in a relatively better situation. This situation is determined by the cooperation established many years ago with international organizations such as Egencia or Frontex. The first partner, apart from providing additional turnover, certainly contributes to the maintenance costs of dedicated employees. This is a big relief for eTravel.

In turn, the key customer of the EU agency Frontex, due to its tasks, has to travel a lot, even in a pandemic. So it will constantly generate the turnover that is needed in these times. Importantly, it is also not a low-margin customer. It can pay for the right service.

eTravel also benefits from other synergies, including the potential to sell a holiday offer to corporate clients. Serving the largest Polish companies, he has a lot of room to show off in the form of “private” service for their employees.

Will new players benefit and compact offices will take over employees?

The market shows the increased activity of smaller players. Investments in advertising include Trivium, Old Town or Bissole. The sales results clearly show that this type of agents are doing much better than the giants.

New entities entering the market will certainly want to take advantage of the problems of large players. The fate of innovative ticket booking platforms such as Hotaliors and Stery is particularly interesting. These companies may also have ambitions to become quasi TMC.

As if that was not enough, B2B platforms – active and known so far from RateHawk hotels, as well as the Indian giant TBO Holidays, will also compete for the airline ticket market. This will not make life easier for traditional business travel agents in crisis.

TBO Holidays to expand in Central Europe – hotel b2b content and self booking as game changer?

Redundancies from leaders can be an opportunity for aspiring agencies to attract valuable staff. Such as Profi Travel or GAS.

What does LOT Travel do in this context?

It is also worth looking at the activities of the LOT subsidiary in the context of those undertaken by market leaders. So far, we do not see any significant cost reduction moves here. The regional offices are still operating and the headquarters are doing well in the LOT office building.

The question is how to finance this well-being. It is difficult to assume that the company operates on commercial terms when looking at the situation in the industry.

In the context of painful layoffs of employees in the sector, the pressure to heal the segment of public tenders for business trips may also increase. The practice so far has largely closed the way for global agents to participate. It also translated into lower innovation and poorer quality of service in this segment. Now is the time to clear this situation up?

POWIĄZANE WPISY

20 marca 2024

Festiwal „Szlakiem wody” 22 marca w Hydropolis

Z okazji Światowego Dnia Wody 22 marca 2024 Hydropolis oraz kolektyw Outriders zapraszają…

0 Komentarzy3 Minuty

19 marca 2024

Strategiczna współpraca Banku Pekao S.A. i PLL LOT

Dzięki strategicznej współpracy PLL LOT z Bankiem Pekao S.A. klienci banku mogą korzystać…

0 Komentarzy5 Minuty

15 marca 2024

Blisko 15 mln turystów odwiedziło Egipt w 2023

Na targach ITB Egipt pochwalił się 15 mln odwiedzających w 2023 roku, nowa kampanią…

0 Komentarzy6 Minuty

15 marca 2024

Austria na ITB: innowacje, zrównoważony rozwój i austriacki styl życia

Na ITB Austria przedstawiła nową kampanię promocyjną odwołującą się do „Lebensgefühl” –…

0 Komentarzy7 Minuty

13 marca 2024

DER Touristik zmienia się w Dertour i prognozuje wzrost obrotów o 30 proc. w 2024

W 2023 roku grupa DER Touristik osiągnęła 23 proc. wzrost obrotów i patrzy z optymizmem…

0 Komentarzy5 Minuty

8 marca 2024

MTT Wrocław: rozpoczynamy sezon na podróże

W dniach 22–24 marca we Wrocławiu odbędzie się kolejna, 15. już edycja Międzynarodowych…

0 Komentarzy2 Minuty

4 marca 2024

Nie podzielić losu dinozaura, czyli jak odmłodzić kadry w turystyce? Debata na Forum Promocji Turystycznej

Podczas wiosennej edycji Forum Promocji Turystycznej, która odbędzie się 11 kwietnia 2024…

1 Komentarz2 Minuty

28 lutego 2024

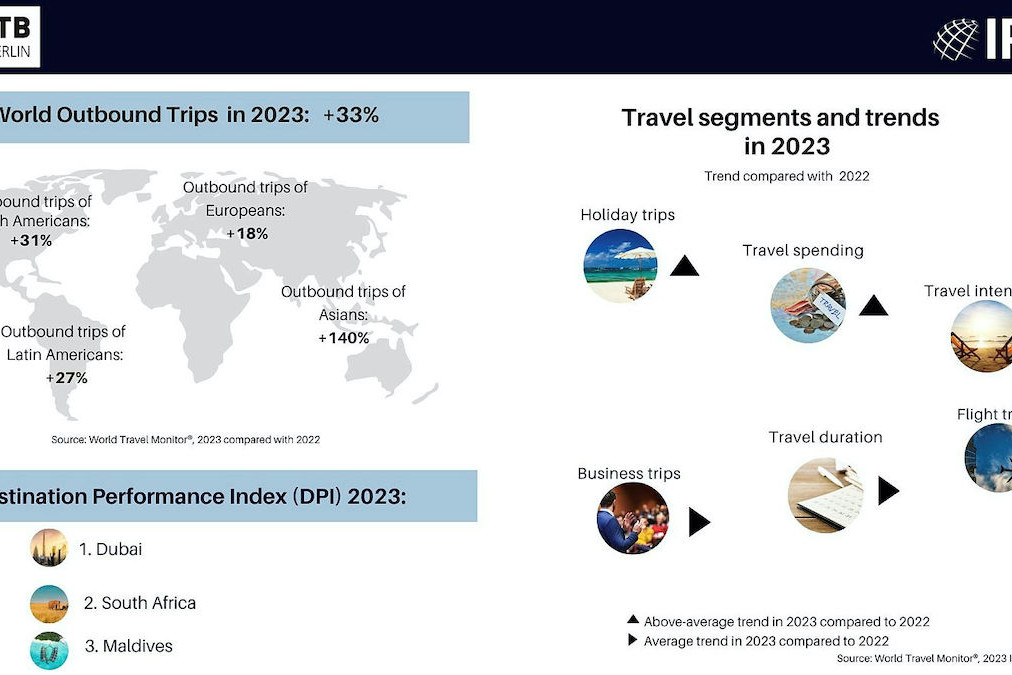

Turystyka wyjazdowa z 33 proc. wzrostem

Zgodnie z raportem przygotowanym przez ITB i IPK International globalna turystyka…

0 Komentarzy5 Minuty

28 lutego 2024

Do 8 marca przyjmowane są zgłoszenia do Kryształów Turystyki

Kryształy Turystyki przyznawane są w trakcie Targów Turystyki i czasu wolnego we…

0 Komentarzy2 Minuty