GSA/DMC Rep market towards transformation – will regional airports enter the game?

Will the current representation model for airlines and DMC survive? Global organizations will stay in business? Should regional airports come into play?

Covid had a dramatic impact on the GSA / Representation segment. Withdrawal of new airlines from the market, basing the business on a commission model, as well as the trend towards mergers and joint management (airline JV), do not leave much room for the current business model.

Global players are exhausting the potential

The GSA market for airlines has been divided by several players for years. Aviareps, Discover the World or Tal Aviation, who dealt cards on it. In Poland, companies from the Czech Republic, which first noticed the potential of the regional offer, also tried to win. Hence the strong presence in Poland of Globair or Travel Advance, which specializes in representing destinations.

Recent market events mean that large / corporatized organizations will not be able to survive on the market. At least not as it is. Discover the World has de facto disappeared from the market, Tal Aviation has closed/moved its representative office in Warsaw to much cheaper location.

The industry is bleeding while losing valuable staff

In the present situation, however, basing representative cooperation on sales commission leads to a dramatic reduction in employment. Entities in the rep industry are unable to keep employees. We can see it on the example of TravelReps or the recently established company Insider. Also people / icons present on the Rep market for years are changing industries. Kasia Kajak is realized in Realestate and Justyna Skubis in network marketing / cosmetics for women. And these are just a few of many examples.

It is difficult to say how quickly such staff losses can be rebuilt. Rather, one should be a skeptic here.

Regional approach the key to success?

It seems that the organizations allowing to exploit regional synergies still have the best chance. Most of the future contracts will still apply to the entire area of Central Europe. Only those who cut costs at the headquarters and leave salesmen in neighboring countries will be able to survive. This approach seems to be successfully introduced by Travel Advance.

Interestingly, it is strange that for the time being there is no entity here that would attempt to use lower operating costs in Eastern Poland or Western Ukraine. Locating its operational headquarter here for the markets of Central Europe. For the purpose of servicing airlines, it would be ideal to cooperate with a neutral IATA agent. It could provide ticketing resources for both individual and group pax. In Polish realities, an example of such an agent is Hurra from Iława. The current leader in selling airline tickets in Poland.

Minus 84% in air ticket sales after half of Feb – duty trips dying only exotic holidays counts

Do you have groups (mark up), will you experience the example of Aegen / Tap or Fly Dubai?

In the case of Gsa, the recipe for success was significant group selling for airlines. Fees/monopoly for brokerage in the sale of groups and sometimes also mark-up were the basis for the maintenance of Aviareps / TAP pilgrimage groups, Intair (once CSA today of the Fly Dubai group) or Globair (Greek Aegen).

Without this kind of influence, it is basically impossible to maintain an organization.

The partners ‘(airlines’) requirements are large compared to what they offer for their representation services

Currently, on the market we have single cases of lines that are trying to enter Poland and are looking for representation. However, these will mainly be hybrid / low cost lines. Just like Sky up announcing the entry or Nordwind from Russia, which is about to join him. Such entities, by offering cheap tickets and without a long-haul offer, will not make GSA survive. The commission itself will be symbolic.

The expected revenues from new players versus their expectations. I.E. hiring a sales manager and holding a certain number of meetings or business trips seem to be far from being missed.

The solution is to introduce a fair “flat fee” for service in the contracts. But this may meet resistance in lines accustomed to saving. In this way, the chance for their market success decreases significantly.

The market is moving towards project work/freelancers ?

Project work / freelancers can be a kind of solution. Such an “entry market project” consisting in advising the airline, holding a series of meetings or preparing a marketing plan could be beneficial for both sides. In case of success, the cooperation could be continued.

An important advantage could also be based on a B2B contract. I.E. avoiding a long-term employment relationship, which can be beneficial for both parties.

Should regional airports enter this business by building competencies supporting airlines?

An interesting idea slightly related to the model suggested above may be entering the GSA / Representation of regional airports business. Preparation of a multi-disciplinary manager within their structure. Who would know the agency / corporate market perfectly of airport catchment area.

The advantage of airports is also the office infrastructure, so investments in the workplace would be symbolic.

Such a manager could also be an asset in negotiations with airlines. By bringing added value that would induce those who do not have knowledge about the market to decide to enter Poland. The need to reach all stakeholders is also indicated by problems with starting business connections from regions. It can be assumed that if not taken care of commercially, the connections will not sell themselves.

Geographic/regional specialization may make sense – targeting Berlin or Małopolska?

We still lack geographic specialization in the GSA market. Basically, all entities in the industry are concentrated in Warsaw. However, it can be imagined that, for example, an entity operating from Poznań could generate a very significant added value for the airlines flying from Berlin. Many of them are not present in the Polish sky. There are many such cases, from Egypt Air to Delta, Georgian Airways, Hainan Air. And even those that are present often have a better product from Berlin than from Warsaw.

The same is true for southern Poland, including the interesting region of Czech Ostrava. Only recently, at the express request of Fly Dubai, a local sales manager serving the Małopolska market appeared. The lack of commercial figures in the south indicates that the suggestion of airport involvement in commercial representation may be an appropriate/necessary line of reasoning.

POWIĄZANE WPISY

23 kwietnia 2024

Otwarcie sezonu turystycznego w Chorwacji

180 polskich touroperatorów, agentów turystycznych, ekspertów z branży i dziennikarzy…

0 Komentarzy3 Minuty

20 marca 2024

Festiwal „Szlakiem wody” 22 marca w Hydropolis

Z okazji Światowego Dnia Wody 22 marca 2024 Hydropolis oraz kolektyw Outriders zapraszają…

0 Komentarzy3 Minuty

19 marca 2024

Strategiczna współpraca Banku Pekao S.A. i PLL LOT

Dzięki strategicznej współpracy PLL LOT z Bankiem Pekao S.A. klienci banku mogą korzystać…

0 Komentarzy5 Minuty

15 marca 2024

Blisko 15 mln turystów odwiedziło Egipt w 2023

Na targach ITB Egipt pochwalił się 15 mln odwiedzających w 2023 roku, nowa kampanią…

0 Komentarzy6 Minuty

15 marca 2024

Austria na ITB: innowacje, zrównoważony rozwój i austriacki styl życia

Na ITB Austria przedstawiła nową kampanię promocyjną odwołującą się do „Lebensgefühl” –…

0 Komentarzy7 Minuty

13 marca 2024

DER Touristik zmienia się w Dertour i prognozuje wzrost obrotów o 30 proc. w 2024

W 2023 roku grupa DER Touristik osiągnęła 23 proc. wzrost obrotów i patrzy z optymizmem…

0 Komentarzy5 Minuty

8 marca 2024

MTT Wrocław: rozpoczynamy sezon na podróże

W dniach 22–24 marca we Wrocławiu odbędzie się kolejna, 15. już edycja Międzynarodowych…

0 Komentarzy2 Minuty

4 marca 2024

Nie podzielić losu dinozaura, czyli jak odmłodzić kadry w turystyce? Debata na Forum Promocji Turystycznej

Podczas wiosennej edycji Forum Promocji Turystycznej, która odbędzie się 11 kwietnia 2024…

1 Komentarz2 Minuty

28 lutego 2024

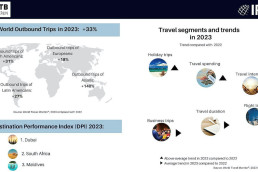

Turystyka wyjazdowa z 33 proc. wzrostem

Zgodnie z raportem przygotowanym przez ITB i IPK International globalna turystyka…

0 Komentarzy5 Minuty